Mutual Funds

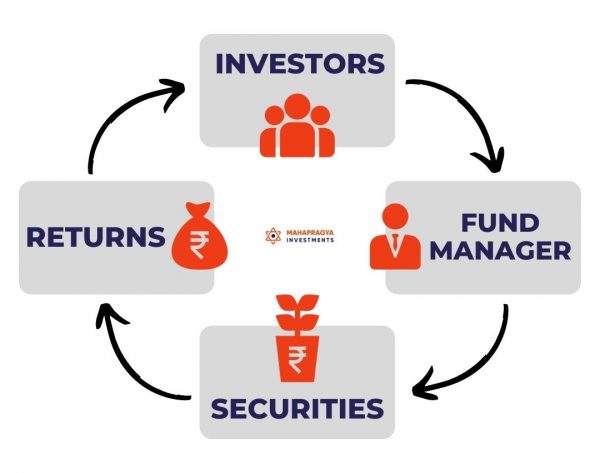

Mutual Funds is a financial product. It is begun and overseen by a Mutual Fund organization that pools cash from different financial backers and puts it in different resource classes like equities, bonds, money market instruments, and Gold.

How Mutual funds work?

Why invest in mutual funds?

Higher Returns

Mutual Funds have generated higher returns than any Bonds or FDs.

Also, you can earn upto 1% extra returns investing in direct mutual funds.

Tax Savings

You can save on taxes from mutual funds investment under section 80C of the Income Tax Act, for investments up to ₹1.5 Lakh in a financial year.

Tense Free Investment

Mutual Funds are managed by highly reputed Fund Managers, who have given and are giving the best returns.

FAQs

We offer you a goal planner where you can set your goals and according to your goals and requirement best mutual funds are suggested to you to invest in.

You can contact us to have access to goal planner.

Mutual Funds offer returns in two ways – Capital Gain and Dividends.

Capital Gain is earned by Investors at the time of sale of the security held by them at a greater value of their purchase price. Dividends are paid out when a company makes profits, and decides to distribute a certain amount of profit to its share holders. Both capital gain and dividends are taxable.

Mutual Funds are taxed on Capital Gain & Dividends.

The taxation of capital gains of mutual funds relies on the holding period and type of mutual fund. The holding period is the span for which the mutual fund units were held by an investor.

As per the amendments made in the Union Budget 2020, dividends offered by any mutual fund scheme are taxed in the traditional manner. That is, dividends received by investors are added to their taxable income and taxed at their respective income tax slab rates.