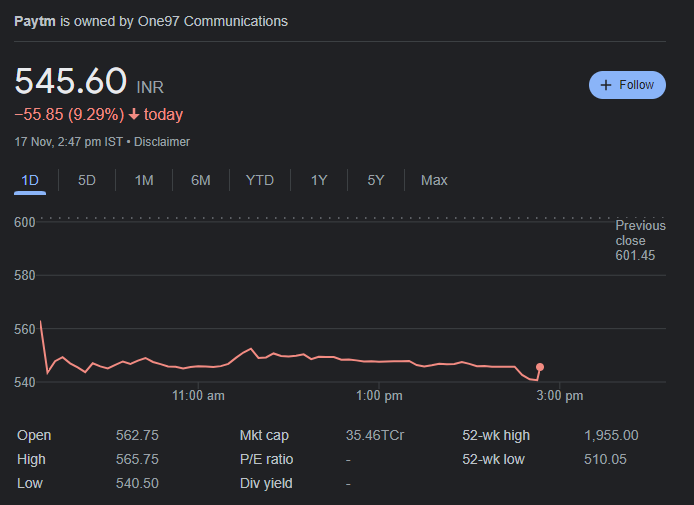

After Reuters reported that SoftBank Group Corp may sell up to $215 million worth of shares in the Indian e-payment platform, shares of Paytm’s parent company, One 97 Communications Ltd, plummeted as much as 10% to their lowest level since May.

According to a term sheet accessed by Reuters, the stock is being sold in the range of 555 to 601.45 per share.

According to a term sheet accessed by Reuters, SoftBank Group Corp intends to sell up to $215 million worth of shares in the parent company of Indian e-payments giant Paytm, One 97 Communications Ltd.

As of September 30th, SoftBank held a 17.5% interest in the digital payments and fintech startup.

The bottom of the range represents a 7.7% discount from the company’s previous closing price. The sale’s ultimate price will be determined later on Thursday.

The sale is the latest in a series of divestments undertaken by SoftBank in recent months after its flagship Vision Fund subsidiary incurred losses of roughly $50 billion in only six months.

SoftBank and Paytm did not reply to comment queries.

According to the term sheet, SoftBank is selling 29 million shares in a transaction that is being overseen by Bank of America.

The announcement comes one day after the lock-in period for investors in Paytm’s initial public offering in November 2021 ended. Wednesday’s closing price for the company’s stock was 601.30 rupees, down 4% from its five-month low.

Earlier this year, SoftBank raised $2.4 billion by selling T-Mobile US shares.

Vision Fund sold a variety of assets in the April-June quarter for a realized gain of $5.6 billion, including ride-hailing company Uber Technologies and property platforms Opendoor Technologies and KE Holdings, which owns China’s Beike.