The US Federal Reserve continues to reduce the magnitude of its rate hikes, from 75 basis points to 50 basis points, and now to the typical 25 basis point level. With this increase, the goal range for the Fed Funds rate is now between 4.5 and 4.75 percent, and there are sufficient indications that a couple more rate hikes remain before the central bank stops.

Although it is uncertain how long the elevated interest rates will persist, certain concerns over the global and U.S. economies are diminishing. This likely explains the bullish reaction of equities markets and the adjustment in the yield curve for government bonds.

US economic growth slows, but the labour market remains robust

Recent indications indicate modest growth in expenditures and output. The decline in consumer expenditure is the result of tighter financial conditions. The housing market and company fixed investment remain weighed down by rising mortgage and interest rates.

In addition, the rate of employment growth has slowed over the past year, and nominal pay growth has shown symptoms of moderating. Despite this, the labour market remains competitive. The ratio of job vacancies to job seekers has increased to 1.9x.

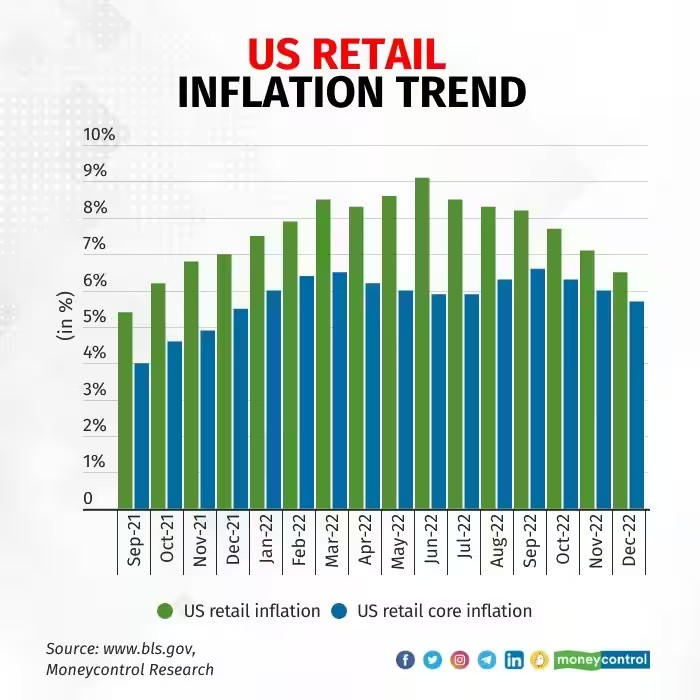

Even while there has been consistent disinflation, with a decline of around 250 basis points since June 2022, the current CPI figure (6.5 percent) is still highly elevated and well above the targeted policy rate. And with a robust labour market, there is the potential for inflation to rebound if monetary policy does not remain sufficiently restrictive.

US Retail Inflation Trend

A viewpoint on inflation

For purposes of analysis, inflation can be divided into three categories. First, goods inflation is already declining as a result of supply-chain constraints being alleviated and demand moderating. Second, it is anticipated that housing services inflation would moderate when new leases at reduced rates are signed.

Non-housing-related services inflation is the most problematic component of headline inflation. This comprises about 55 percent of the PCE index and is persistent due to the robust labour market. As many components of the inflation index have yet to experience deflation, the Fed’s work is incomplete.

Takeaways

The real challenge for the United States is therefore demand-driven inflation. The longer it takes to rein in inflation expectations, the greater the chance that they may become entrenched and influence economic decisions.

At the same time, however, financial conditions have been sufficiently tightened, retail demand has diminished, the supply side has loosened, and prices for goods are plummeting. This suggests that the Fed may stop after one or two meetings to observe the delayed impact of previous rate hikes.

Since October 2022, however, adverse risks to world economy have diminished, as stated by the IMF. China’s recovery is on the horizon, Europe is able to weather the energy crisis in the present season, and the United States’ risk of recession has decreased as a result of consistent employment.

Consequently, the Indian market is in an intriguing position. As a result of an improvement in global prospects, the growth premium enjoyed by the domestic market will diminish. Given superior regional value wagers, FIIs will continue to churn their portfolios.

Nonetheless, domestic stocks would continue to be supported by a healthy macro and generally stable earnings outlook, despite the moderation of some high frequency data. Moreover, because the fiscal glide path has been adhered to, the recent thrust of the budget is directionally beneficial for stocks.

Consider stocks and industries supported by policy support, earnings direction, and value. In this regard, infrastructure, green energy, consumption, domestic travel/hospitality, China plus beneficiaries (Chemicals, Automobiles), and defence continue to be areas of particular interest.