Investing is an exciting path that has the potential to lead to financial independence, so long as you remain focused, disciplined, and attempt to keep things simple. Numerous individuals enter the market with enormous expectations and are frequently let down. If we’ve learned anything from our travels, it’s that the market doesn’t exist only to provide you with what you want. It will take its own course of action, and as an investor, you should always remain focused, make regular SIPs, keep things simple, and give yourself sufficient time to succeed in the markets. Believe me, this is totally feasible.

Before proceeding, we would want to emphasize that we are a SEBI-registered Research Analyst and not a financial counselor. Contact a professional before making any decisions.

Before embarking on an investment journey, there are four key data-supported considerations that should always be kept in mind. Even if you are already on the market, these tips will still be beneficial.

Prior to entering the market, the first and most essential step is to evaluate your objectives and risk tolerance. This must be completed early so that you do not invest funds that may be required soon. It is preferable to leave the money invested in the market undisturbed for as long as possible in order to experience compounding.

1. The significance of considering Long Term

This represents the Nifty 50 from July 2021 to October 2022. You can observe tremendous volatility. Someone who began their journey around September 2021 must have encountered considerable turbulence. At the end of the 12-month period, they must have felt disheartened because their returns were nil, despite the fact that everyone else assured them that the markets might be extremely lucrative.

Now view the Nifty 50 on a monthly basis. Is it not patently evident that markets have only risen? This is the power of long-term thinking. Let me show you some intriguing facts to help you hit this target a bit more precisely.

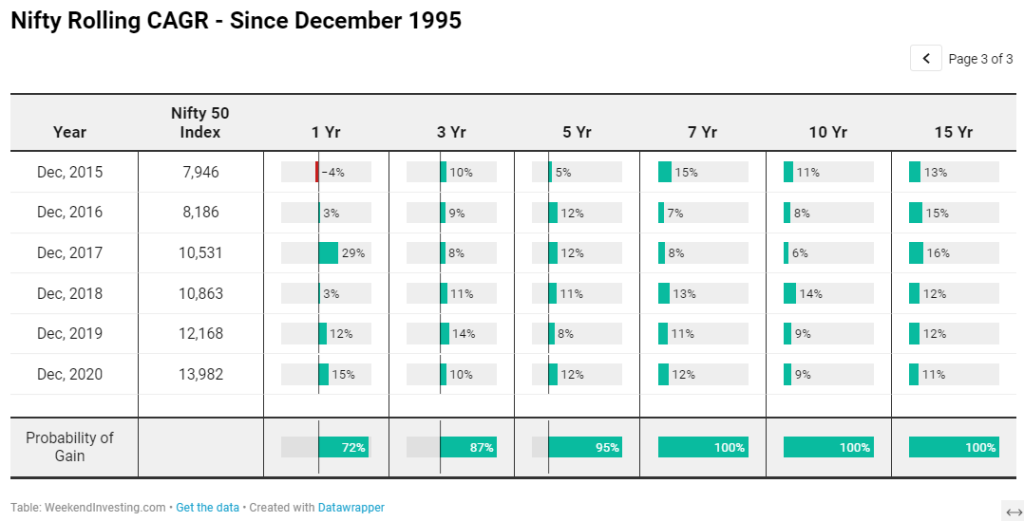

Since December 1995, the above graph displays Nifty’s Rolling CAGR for various time periods ranging from 1 to 15 years. Use this link to access the interactive chart in its entirety.

If you are unfamiliar with Rolling Returns, you should read this article. This data makes one thing abundantly clear: the longer you remain in the markets, the greater the likelihood of a prosperous journey. During any seven-year period, you would have never lost money investing. If you invested for 15 years, you would have earned a CAGR in double digits for each 15-year period.

More intriguing is the fact that you would have still achieved a CAGR of 11% between 2005 and 2020, despite various periods of turmoil such as the Great Recession.

- The global financial crisis of 2008 – a 65% decline

- 25% decline in 2015

- 38% decline in 2020 (COVID crash)

Despite all of these obstacles, a CAGR of 11% between 2005 and 2020 must be phenomenal, right? This is the power of investing for extended periods of time in the market.

2. SIP is extremely fantastic; do not disregard its power

There are only three possible outcomes following an investment.

- Markets move up

- Markets stay flat

- Markets decline

A SIP is successful in two of the three aforementioned situations. Investing in a lump sum is superior to investing in a systematic investment plan only if the market goes straight up following your investment.

In this video, we have described this in incredibly simple terms with numerous instances.

In addition, we can demonstrate that you would still make money if you began investing at market peaks such as the 2008 global financial crisis crash, the 2015 decline, or the 2020 COVID crash, which we have outlined.

SIPs are also crucial in eliminating anchoring bias (over reliance on what one originally thinks).

For optimal benefits, stay consistent and regular with your SIPs and strive to increase the SIP amount each year in proportion to your income growth.

3. Beware of declines

Drawdowns may be a terrible ordeal. Surprisingly few individuals comprehend drawdowns correctly. We at Mahapragya Investments are adamant that one must have an approximation of the investment’s possible downfall. Exist any plans, if any, for market collapses? Is there a proactive approach to dealing with bad market conditions?

The largest decline from a peak is known as the maximum drawdown. This depicts the greatest decline from a portfolio’s highest point. The current ebb is the distance to the summit. This shows the recent performance of the strategy and illustrates the portfolio’s distance from its highest peak. If the current drawdown is consistently 0%, the portfolio is on an uptrend and is regularly reaching new highs. In contrast, if the current drawdown is equivalent to or within a tight range of the maximum drawdown, it indicates a downward trend in the portfolio.

The heart of this argument is that the lower the drawdowns, the greater the likelihood of long-term outperformance. Depending on market conditions, our strategies adhere to the strongest stocks in their respective universes (rotational momentum) or efficiently go to cash (absolute momentum). Check the historical drawdowns of a strategy, if available, prior to embarking on a journey.

4. The checklist’s four items

- What should you buy?

- When should you buy?

- How much should be invested?

- When should you sell?

If you are unable to comprehend the first three points, we are confident that the following four guidelines will prevent you from making a few errors and shorten your learning curve.

- What should you buy – Always have a clear idea of what to buy before purchasing a stock. The rationale for purchasing this stock should be very apparent, and there should be no ambiguity whatsoever in this regard. If you are uncertain, abandon that stock and go on to the next.

- When should you buy – When should you add a stock to your portfolio is a crucial question to consider. When is a stock added to your portfolio? Currently or later? There must be a complete understanding regarding “when.”

- How much should be invested – What quantity is added to a specific stock? How heavily does it factor into your total portfolio? Why should a stock carry a particular weight in your portfolio?

- When should you sell – Perhaps the most important criterion is to sell at the right time without incurring losses or giving up gains. Have a plan that identifies an appropriate exit strategy for the stock you already own or intend to buy. Lacking a defined exit strategy is nearly suicidal and can result in catastrophic drawdowns.

Despite the fact that there are undoubtedly a great number of additional considerations, we wished to highlight some essential characteristics that might foster the proper mindset for a fulfilling, long-lasting journey.